In #STONchronicles we share the technical breakthroughs and product milestones that showcase our commitment to building the future of DeFi on TON.

🔹 Omniston now chains swaps across multiple DEXs in one transaction.

🔹 Better prices via deeper liquidity — Omniston aggregates routes across DEXs, which reduces price impact and raises the chance of a superior rate.

🔹 Big picture: one network, many protocols, united through Omniston — expanding the liquidity surface for every app and user.

🔹 What’s next: active development toward cross-chain connectivity to amplify liquidity and bring more users into TON DeFi.

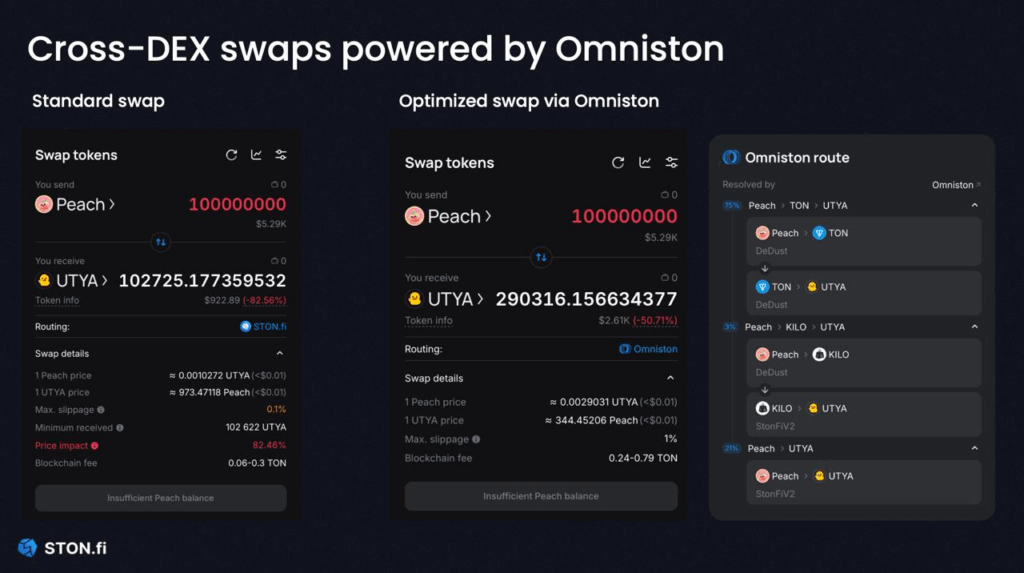

Swapping tokens on TON is already one of the smoothest experiences in DeFi. But now it’s getting even smarter. With the introduction of cross-DEX swaps in Omniston, users can execute trades that combine liquidity from multiple decentralized exchanges — all in a single transaction.

| Looking ahead, Omniston is more than just an upgrade to how swaps work today — it’s the bridge to tomorrow. Development is already in motion, and the future is closer than it might seem: our engineers are shaping the infrastructure that will connect TON with other blockchains, amplify liquidity, and attract new users. We believe that STON.fi and Omniston will scale TON DeFi and position it as a central hub in the broader world of decentralized finance. |

What’s new: cross-DEX swaps explained

Until now, swap “hops” only worked within a single DEX. You were limited by one liquidity source — and sometimes missed out on better rates elsewhere.

🔎 Example how it worked before: Imagine you want to swap Gemston → tsTON.

If the best Gemston → TON pool is on STON.fi but the best TON → tsTON pool is on DeDust, a single-DEX hop couldn’t use both venues automatically. You either accepted a worse rate by forcing both legs on one DEX or manually did two separate swaps in two apps (more clicks, more time, more price impact risk).

That changes today. Omniston now supports chained swaps across multiple DEXs by using TON as an intermediate asset.

🔎 Example: Want to swap Gemston → tsTON?

- Omniston executes Gemston → TON via STON.fi V2

- Then TON → tsTON via DeDust

- All as one seamless operation, invisible for users

This unlocks more liquidity sources and maximizes your chance of finding the best possible price.

All you notice is a single interface with the most competitive swap conditions across the TON ecosystem. Behind the scenes, Omniston is doing the heavy lifting.

Have a look at what happens with Omniston-optimized cross-DEX swaps: you get a 32% lower price impact!

Why it matters

Cross-DEX swaps are more than a technical upgrade — they redefine the user experience:

- Better prices via Omniston aggregation. Omniston deepens effective liquidity and helps reduce price impact.

- No complexity. One interface, one signature, one transaction.

- Future-ready. Growing support as more protocols join Omniston.

Who benefits

Users

Enjoy best-route pricing sourced from multiple DEXs with one tap. No juggling apps, no manual comparisons — just smarter swaps.

Builders (and their users!)

Any third-party DEX, wallet, or app that integrates Omniston gains instant access to cross-DEX routing in their own interface. Integrate once → unlock deeper liquidity, better execution, and a superior UX for your users.

Cross-DEX swaps are more than an upgrade to swapping — they’re a blueprint for how TON DeFi scales: one network, many protocols, united through Omniston. As new venues plug in, Omniston continuously expands the liquidity surface area available to every user and app.

This is how we see the future of DeFi on TON: simple on the surface, powerful behind the scenes — and always routing you to the best possible outcome.