Looping lets TON/USDt v2 LP tokens work twice: LP-tokens are supplied to EVAA as collateral, then assets from EVAA are borrowed, and added as liquidity on STON.fi — repeating while Health Factor is healthy. A looping strategy may amplify exposure and fee potential; still, there are some risks. This article shows the clicks and the trade-offs.

Before you start

✅ DYOR: We do not provide any financial recommendation. In the world of DeFi you should always research projects thoroughly and make decisions independently.

✅ A TON wallet connected to both apps (STON.fi and EVAA), plus a bit of TON for fees.

✅ You understand EVAA basics: what is collateral, Health Factor, liquidation thresholds. Read these in EVAA’s docs.

✅ You accept the risks: market moves, impermanent loss, rate changes.

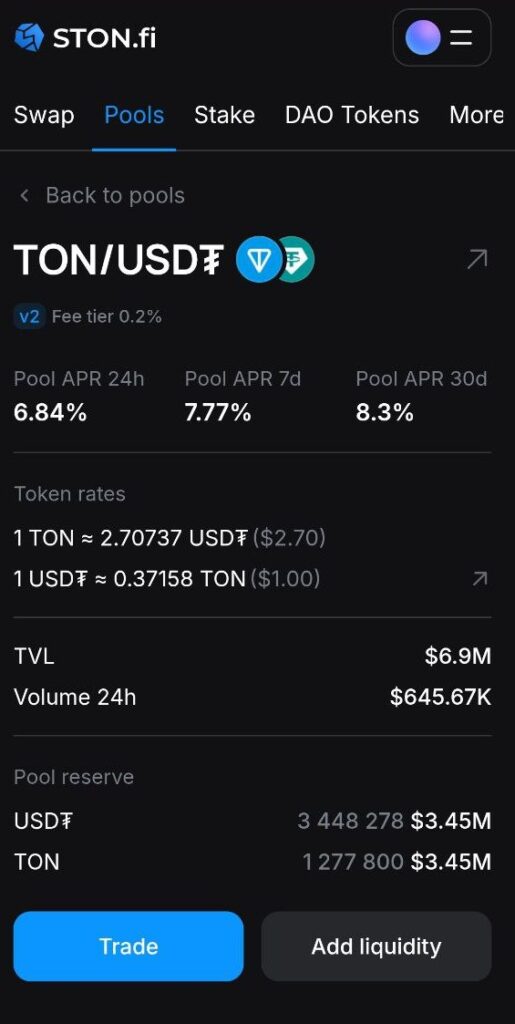

Step 1. How to provide liquidity on STON.fi and get LP tokens

Go to the STON.fi app to provide liquidity in the TON/USDt v2 pool. Go to Pools → Select TON/USDt v2 → Enter the amount you wish to provide → Click Add liquidity.

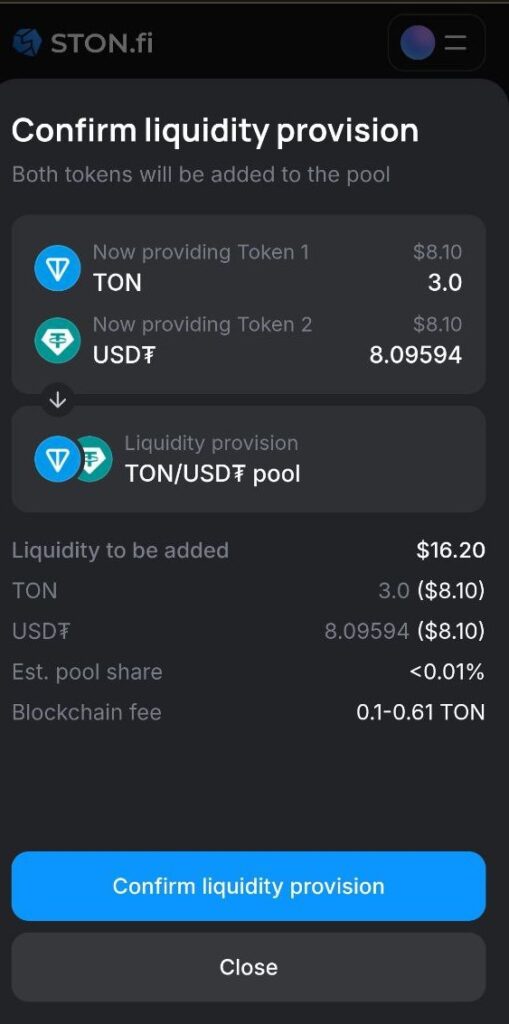

Click Preview liquidity provision, check all the details and click Confirm liquidity provision.

Now LP tokens may be used as a collateral on EVAA.

Step 2. How to connect to EVAA

Go to the EVAA app. If you’re in the app for the first time, connect your wallet from the home screen prompts.

Now it’s possible to start using supply&borrow opportunities of the EVAA protocol.

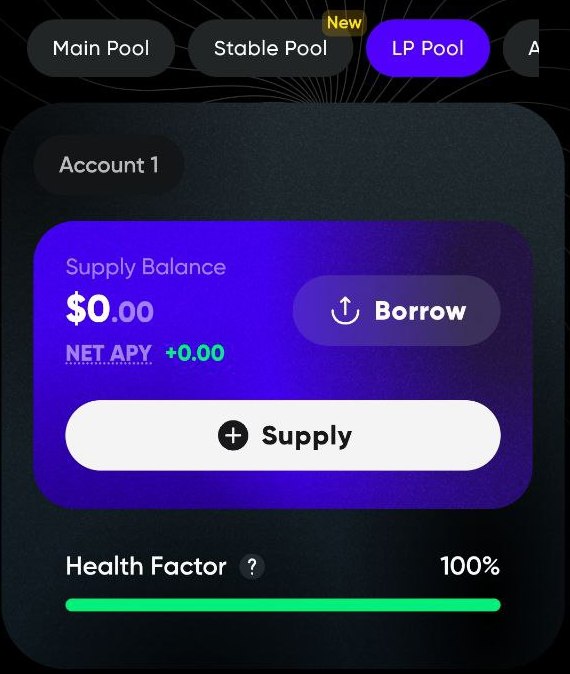

Step 3. How to supply LP to EVAA and enable as collateral

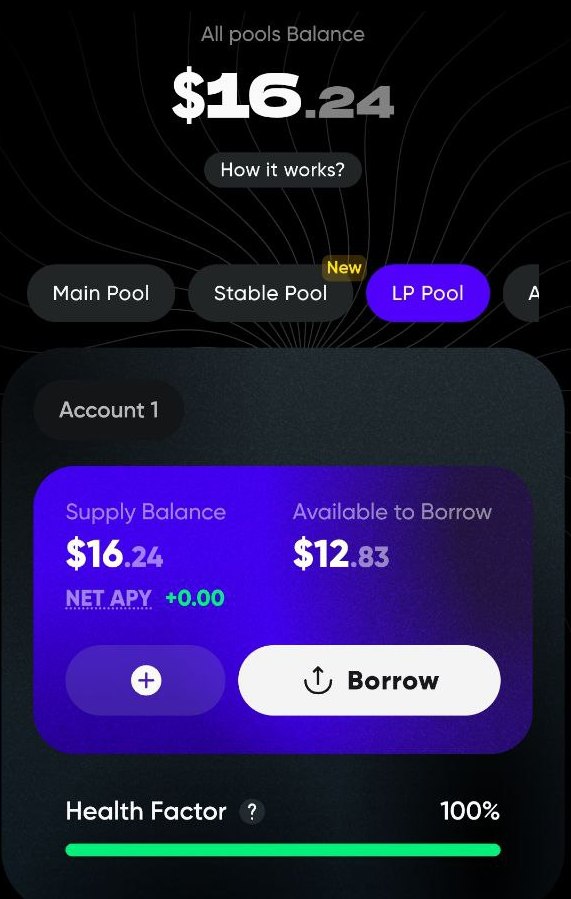

On Home page select LP pool and click Supply.

Choose a supply asset — in our case it is TON/USDT-LP (STON.fi v2).

Click Supply and choose the amount of LP tokens accessible you want to supply to EVAA. You may indicate the number or choose a share — 25%, 50%, 75% or 100%.

Step 4. How to borrow responsibly

Now there’s an option to borrow funds and then provide them as liquidity back into STON.fi pool. That’s how to do it.

On EVAA Home page click Borrow.

Choose an asset to borrow and enter the amount.

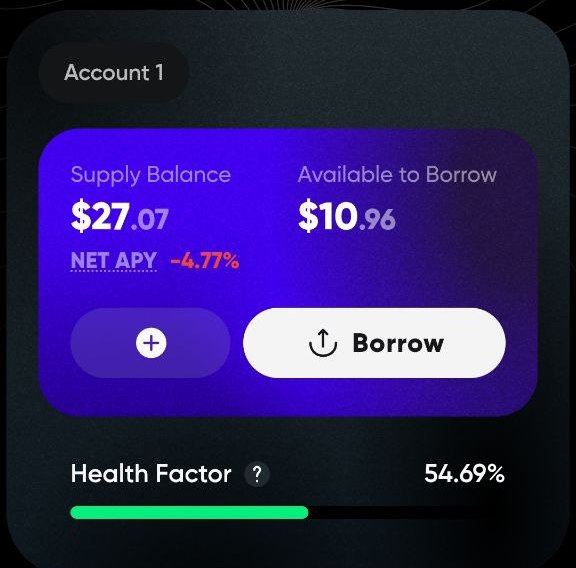

⚠️ Each borrow reduces Health Factor; a conservative buffer should be kept.

Step 5. How to add the borrowed funds back to STON.fi liquidity

Now borrowed funds may be used for extra liquidity provision in the STON.fi TON/USDt v2 liquidity pool. Perform actions in Step 1.

(Optional) Step 6. How to repeat the loop with caution

Any LP tokens gained may be supplied back to the EVAA protocol again.Perform actions in Steps 3–5.

⚠️ Important! Each loop raises exposure and risk. LP token value can change with TON/USDt price and impermanent loss. When LP value dips, collateral value dips, and Health Factor falls. Borrow conservatively. Keep Health Factor high and monitor it after each action.

Best practices & tips

- Favor fewer, safer loops; small buffers save big headaches.

- Watch HF after every action; don’t ignore warnings.

- Keep some stable balance ready for fast top-ups or partial repayments if markets wobble.

- Re-read market parameters on EVAA; rates and caps can change.

- Track your LP’s fee income — it’s part of the reason to loop, but don’t rely on it to bail out risky HF.

- Always DYOR: in DeFi you should research thoroughly everything you decide to interact with.